Current yield of bond formula

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. As such it is the rate of return expected from the bond in the next year.

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube

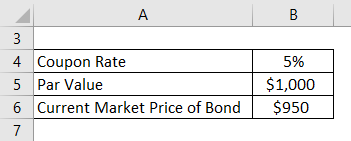

Current Bond Trading Price - The trading price of the bond today.

. Calculating the Current Yield on a Bond. The bond current yield formula is. Bond price when yield decreases by 1 Price.

The High Yield Municipal Bond Fund focuses on non-investment-grade and unrated municipal bonds with a weighted average maturity of more than 10 years. For this particular problem interestingly we start with an estimate before building the actual answer. The current market price of the bond is how much the bond is worth in the current market place.

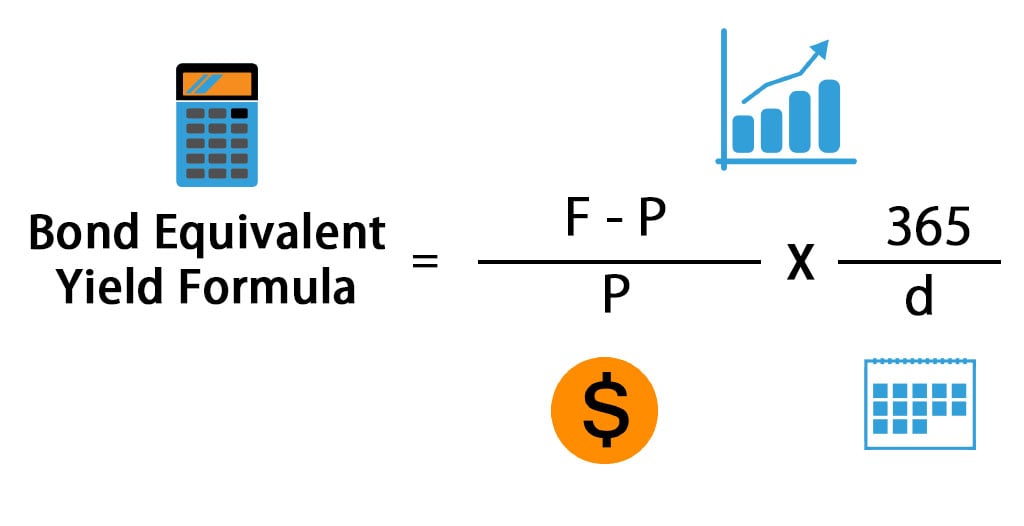

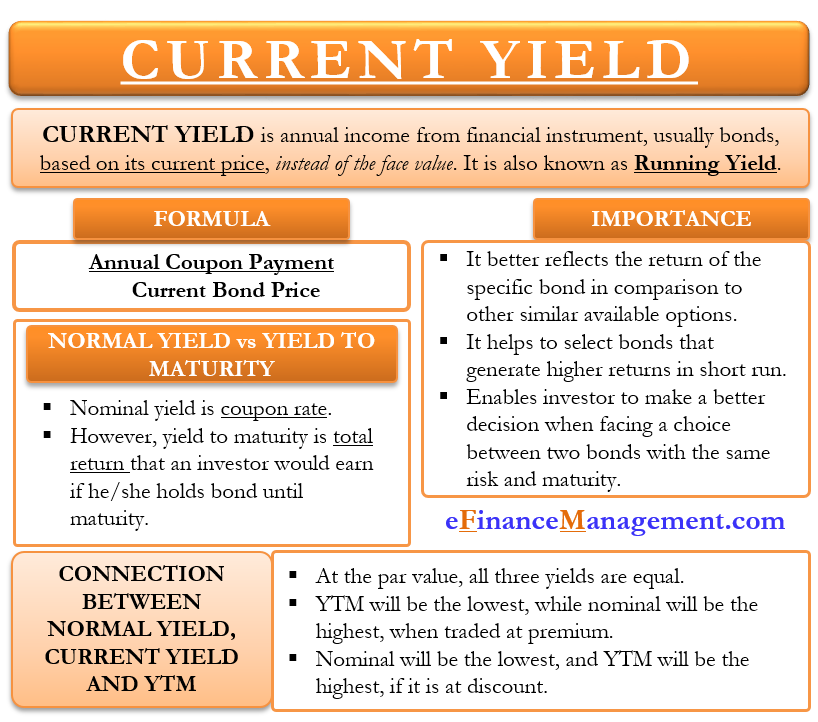

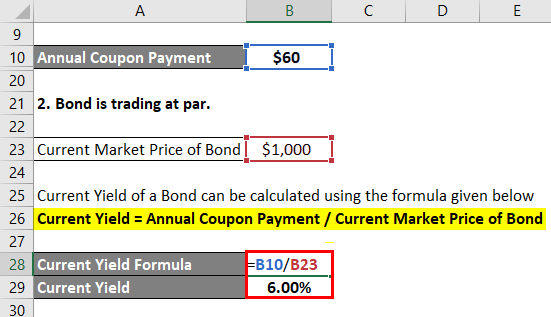

Bond Yield to Maturity Formula. It is calculated as the annual coupon payment divided by the current market price The current yield is an accurate measure of bond yield as it reflects the market sentiment and investor expectations from the bond. Simple yield based upon current trading price and face value of the bond.

The formula for current yield involves two variables. You calculate current yield by dividing the annual interest earnings by the current market price of the bond 5 110 in this case. Bond Face ValuePar Value - The face value of the bond also known as par value.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Bond Prices and Bond Yield have an inverse. The discount rate which makes the present value PV of all the bonds future cash flows equal to its current market price.

In international trade parlance the term current account refers to a nations trade balance for goods and services with the rest of the world plus net earnings from abroad and net transfer payments over a period of time which may be monthly quarterly or. What is Current Yield of a Bond Formula. Current Account Formula Table of Contents Formula.

YTM takes into account the regular coupon payments made plus the return of. The term current yield of a bond refers to the rate of return expected currently from the bond based on its annual coupon payment and its current market price. Yield to Call Calculator Inputs.

The formula for current yield is very simple and can be derived. Percentage point change in yield note that its squared. The Macaulay duration is the weighted average term to maturity of the cash flows from a bond.

Price to Call - Generally callable bonds can only be called at some premium to par value. To calculate current yield we must know the annual cash inflow of the bond as well as the current market price. A Limited and B Limited entered into a 5-month forward contract to trade a bond at 60.

The bond pays out 21 every six months so this means that the bond pays out 42 every year. The bond yield formula evaluates the returns from investment in a given bond. Bond Yield Formula Annual Coupon Payment Bond Price.

Yields are highly dependent on interest rates. See the current yield calculator for more. If there is a premium enter the price to call the bond in this field.

While the 10-year overall star rating formula seems. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Yield to Maturity YTM Formula.

It is calculated as the percentage of the annual coupon payment to the bond price. It is calculated as the annual cash flows divided by the current market price. Years to Call - The numbers of.

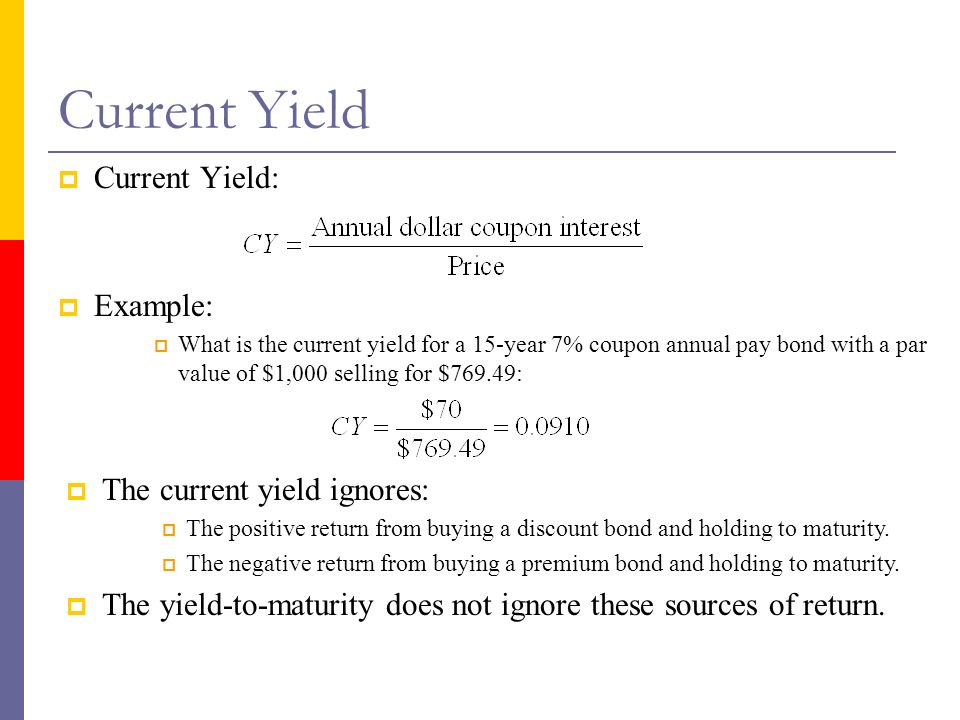

The current yield is distinct from the nominal yield in that it used the current market price of the bond rather than the par value. Current yield is most often used in a bond analysis to calculate its return based on the bonds current price. Bond valuation is a technique for determining the theoretical fair value of a particular bond.

While the current yield and yield-to-maturity YTM formulas may be used to calculate the yield of a bond each method has a different applicationdepending on an investors specific goals. The users will need to take all the values and place them in the formula F S 0 e r-qT to find the forward rate of the financial security with known dividend yield. Several types of bond yields exist including nominal yield which is the interest paid divided by the face value of.

The weight of each cash flow is determined by dividing the present value of the. Said differently the yield to maturity YTM on a bond is its internal rate of return IRR ie. The current yield on a bond depicts the annual coupon as a percentage of the market price which could be higher or lower than par.

Current Yield Coupon Payment Market Price of Bond. Lets work through an example and compute the current yield for an example bond. Bond valuation includes calculating the present value of the bonds future interest payments also.

Get 247 customer support help when you place a homework help service order with us. This is the yield most commonly used when calculating bond spreads. The current yield is the bondholders rate of return if the investment is held for the next year.

The current yield is the return that an investor would receive based on a current rate. Well use the example in the tools defaults. Bond price when yield increases by 1 Price-1.

The current yield of a bond calculates the rate of return on a bond by using the market price of the bond instead of its face value. Annual cash flow and market price. Let us understand the bond yield equation under the current yield in detail.

Total returns for a period of less than one year are cumulative. Current trading price Δyield. Thats right - the actual formula for internal rate of return requires us.

The five-month risk-free rate of interest upon this bond is 6 percent per annum. The current yield of a bond is also referred to as the flat yield interest yield income yield or even the running yield and the definition of current yield is. The results of the formula are expressed as a percentage.

Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page. A bond yield is the amount of return an investor realizes on a bond. Yield to maturity YTM tells bonds investors what their total return would be if they held the bond until maturity.

P - Current market trading price. Find the current yield. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of.

What is a Current Account Formula. Current performance may be higher or lower than the performance shown. ACF - Annual cash flow of the bond.

The formula for calculating the yield to maturity YTM is as follows. The calculation of current yield is a straightforward 3-step process.

Yield To Maturity Fixed Income

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Current Yield Formula Calculator Examples With Excel Template

Bond Equivalent Yield Formula Calculator Excel Template

Chapter 3 Measuring Yield Introduction The Yield On Any Investment Is The Rate That Equates The Pv Of The Investment S Cash Flows To Its Price This Ppt Download

Current Yield Meaning Importance Formula And More

Current Yield Bond Formula And Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template

Current Yield Formula Calculator Examples With Excel Template

Yield To Maturity Ytm Formula And Calculator Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

6 Of 16 Ch 7 Calculating Current Yield Youtube

Bond Yield Calculator

Current Yield Bond Formula And Calculator Excel Template

Bond Yield Calculator

Yield To Maturity Approximate Formula With Calculator

Bond Yield Formula Calculator Example With Excel Template

Komentar

Posting Komentar